Alphabet, the parent company of Google, witnessed a significant setback on Wednesday, with its shares plummeting by 9.5% in a single trading day.

This sharp decline in Alphabet’s stock price was the most significant drop since the early days of the COVID-19 pandemic in March 2020.

The cause of this sudden market shock? Disappointing revenue figures from the company’s Google Cloud unit, which fell short of analyst estimates.

In this article, we’ll dive into the details of this surprising turn of events and its potential implications for Alphabet’s future.

Alphabet’s Unprecedented Plunge:

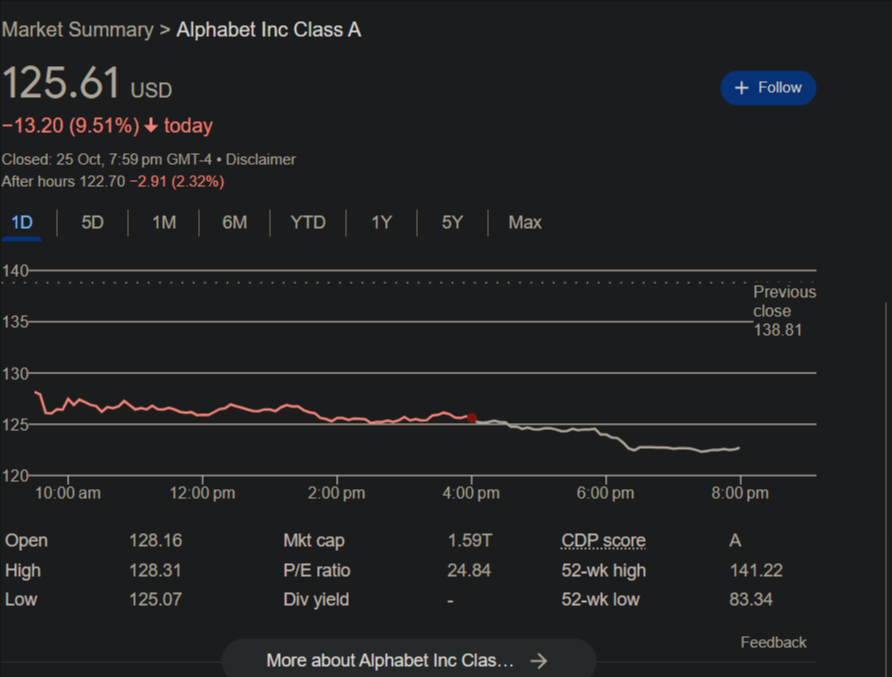

On a tumultuous Wednesday, Alphabet’s stock closed at $125.61, marking a 9.5% decrease. This drastic decline was reminiscent of the 12% slump experienced on March 16, 2020, during the early days of the pandemic’s worldwide lockdowns.

It’s vital to note that this significant drop occurred despite Alphabet surpassing Wall Street expectations in terms of overall revenue and earnings per share.

Cloud Clash: Google vs. Microsoft:

What truly rattled investors was Alphabet’s underwhelming performance in its Google Cloud unit, especially when compared to its tech rival, Microsoft.

Google posted cloud revenue of $8.41 billion, falling short of Street Account estimates that projected revenue to be $8.64 billion. In stark contrast, Microsoft reported accelerating growth in its Intelligent Cloud business.

The disappointment at Google Cloud stood in sharp contrast to the optimism around Microsoft’s cloud-based earnings.

Ruth Porat’s Insights:

Alphabet’s Chief Financial Officer, Ruth Porat, addressed the situation during an investor call. She acknowledged that cloud growth remained strong across various sectors, but she also mentioned the impact of “customer optimization efforts.”

This somewhat cryptic phrase hinted at clients tightening their belts and reducing spending on Google Cloud services.

While this was a logical move for some businesses during uncertain times, it took a toll on Alphabet’s cloud revenue.

Analyst Concerns and Market Reaction:

Several analysts expressed their concerns about Alphabet’s performance in the cloud sector, especially when compared to Microsoft

UBS analysts pointed out that Google’s commentary on customer optimization was a letdown, as investors were hoping for more positive momentum in the cloud space.

KeyBanc analysts also highlighted the limited disclosures about Google’s cloud results, which raised questions about whether Google was losing ground to Microsoft Azure.

Jefferies analysts noted that Google Cloud’s growth rate had slowed to 22%, lagging behind the 28% growth in the second quarter.

The Future of Alphabet and Google Cloud:

Despite this recent setback, Alphabet remains a tech giant with a diverse portfolio of products and services. However, this dip in Google Cloud revenue serves as a reminder that even industry leaders are not immune to market turbulence.

The future of Alphabet will depend on its ability to adapt, innovate, and stay competitive in the fast-evolving tech landscape.

As the company explores generative artificial intelligence and other cutting-edge technologies, investors will be watching closely to see how these initiatives impact Alphabet’s bottom line in the coming years.

Alphabet’s recent stock plunge highlights the challenges and uncertainties that even the biggest players in the tech industry can face.

The underperformance of Google Cloud is a wake-up call for Alphabet, and it will need to address the concerns raised by analysts and investors.

Whether this is a temporary setback or a sign of more significant changes in the tech landscape, only time will tell. For now, the tech world is watching to see how Alphabet responds to this unexpected twist in its financial journey.