S&P 500 Summer Stock Market Rally: Bull Trap Or Reality Check?

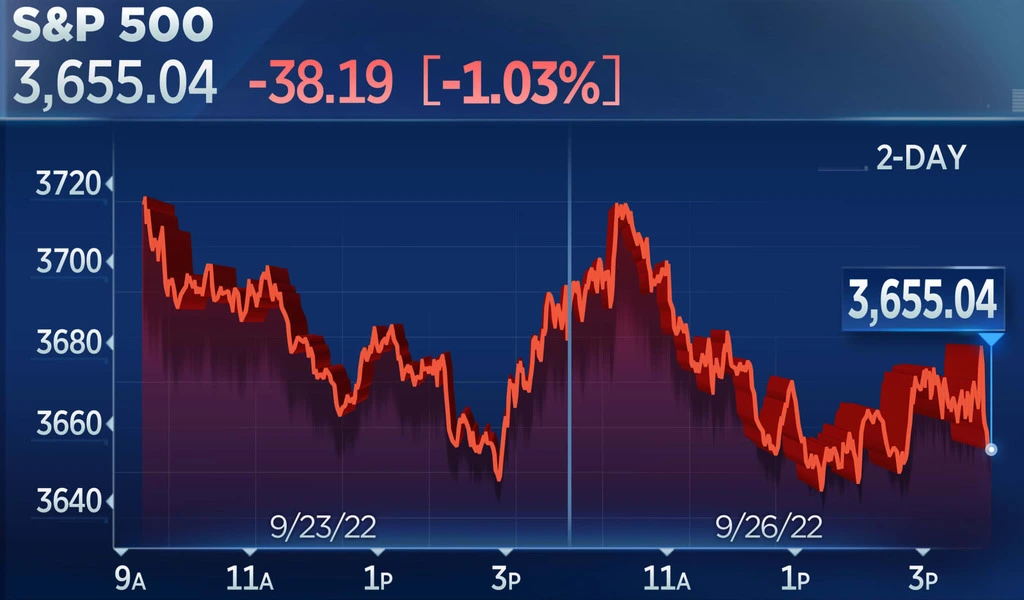

Since the middle of July, stock markets have been on a rollercoaster ride, with sharp declines raising concerns among investors. The S&P 500 and other major indices are teetering on the edge of breaking crucial technical support levels. What started as a summer rally is now turning into a potential nightmare of higher rates and … Read more