Since the middle of July, stock markets have been on a rollercoaster ride, with sharp declines raising concerns among investors. The S&P 500 and other major indices are teetering on the edge of breaking crucial technical support levels.

What started as a summer rally is now turning into a potential nightmare of higher rates and increased market volatility.

The Illusion of a No-Inflation World

Investors seemed to have turned a blind eye to underlying economic factors during the summer rally. Many had hoped for a return to the low-inflation environment of the past 15 years.

However, this optimism has backfired as interest rates have surged to levels not seen in over a decade.

This has left the stock market in a precarious position, as tighter financial conditions are putting pressure on earnings multiples. The stronger U.S. economy, rising oil prices, and persistent inflation have all contributed to this scenario.

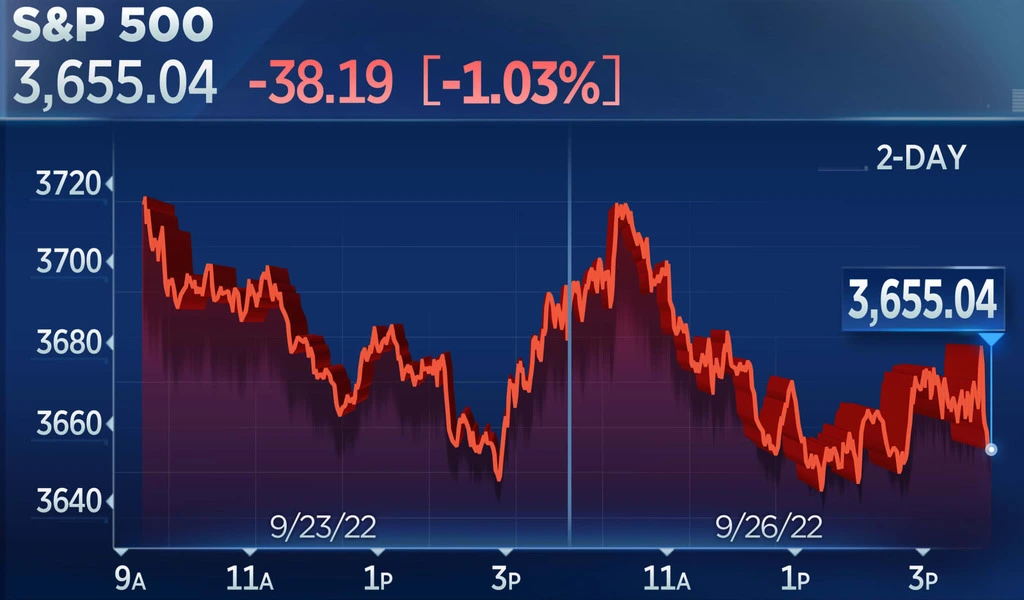

The S&P 500 on the Brink

Currently, the S&P 500 is at a critical juncture, testing a technical support level at 4,320.

This level is significant not only in the short term but also in the long term, as it matches the August 2022 high. If the S&P 500 falls below this level, it could lead to doubts about the entire bull market’s sustainability.

A break below 4,320 might set the stage for a retest of the 200-day moving average, which is around 4,190.

Diamond Reversal Pattern

Adding to the uncertainty, the chart reveals a diamond reversal pattern, suggesting a potential decline to around 4,150 or even below the February 2nd highs at approximately 4,200.

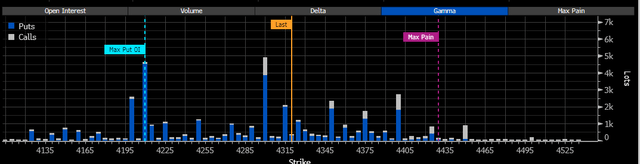

Option Positioning and JPM Collar Options

The upcoming expiration of JPM Collar options contracts adds further intrigue to the market. The presence of a significant open put position at 4,210 makes this level crucial.

If the S&P 500 breaches support at 4,320 and starts descending, the 4,210 level could act as a magnet, drawing the index toward it as the put option’s gamma increases in value.

The Ignored Reality of Rising Rates

While short-term factors play a role in the market’s recent movements, the real driving force behind the decline is the substantial increase in interest rates across the yield curve.

The equity market had largely ignored this trend in previous months, with a focus on potential rate cuts in 2024 and 2023. However, recent data and the Summary of Economic Projections (SEP) indicate otherwise.

The Fed’s acknowledgment of a higher neutral rate or R* is a significant revelation. Market pricing now suggests that the neutral rate is higher than the Fed’s long-run projections of 2.5%.

Fed Fund Futures indicate that rates are unlikely to fall below 4% in the next five years.

This information is crucial as it signals the end of an era characterized by near-zero interest rates and large QE programs.

The Rally Reconsidered

In hindsight, the summer rally appears increasingly unusual. It occurred simultaneously with rising interest rates, disrupting the traditional relationship between real yields and the stock market.

While real rates surged, tech-heavy ETFs like QQQ defied the norm by climbing higher, creating a notable divergence.

It is becoming evident that the summer rally may have been fueled by a short-volatility trade, which is now unwinding. In an environment of rising rates, widening credit spreads, and a strengthening dollar, shorting volatility is a risky proposition.

This is reflected in the recent spike in the VIX index and the 1-Month implied correlation index.

Conclusion

The recent turbulence in stock markets raises questions about the sustainability of the summer rally. As interest rates rise and economic conditions evolve, investors must remain vigilant and reassess their portfolios.

It is crucial to recognize that the era of extremely low interest rates may be coming to an end, and market dynamics are shifting accordingly.

The summer rally may well turn out to be one of the most significant bull traps in recent memory, underscoring the importance of prudent risk management in today’s complex financial landscape.