The electric vehicle (EV) market is undergoing a seismic shift, and two giants are leading the charge – Tesla and BYD.

While many EV startups and traditional automakers are grabbing headlines, these two companies stand out as the world’s largest EV makers, with an intense rivalry that extends from China to the global stage.

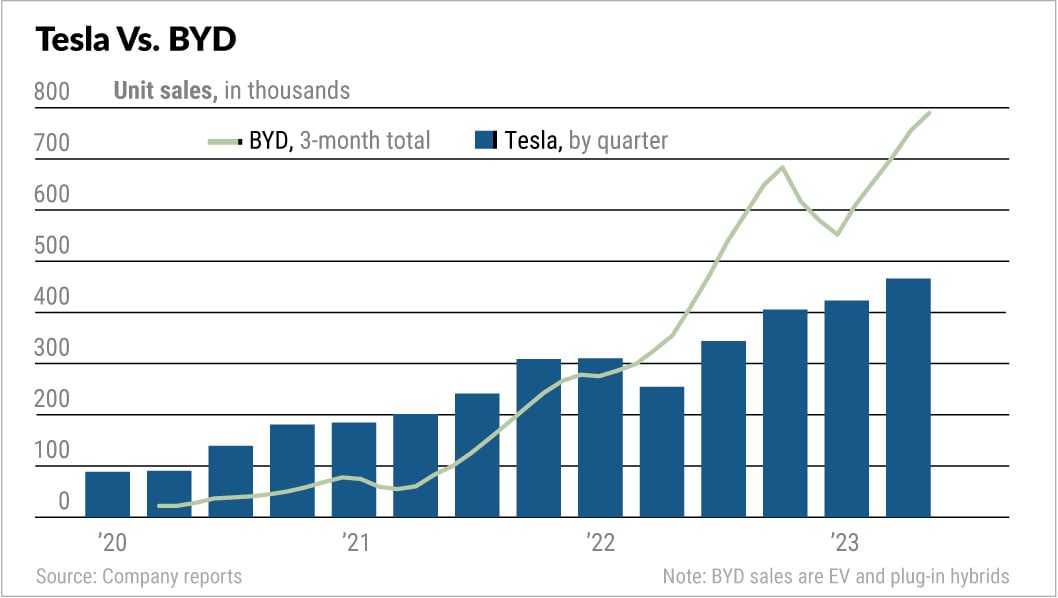

In 2022, China’s BYD raced ahead of Tesla in total vehicle sales, marking a significant milestone. While Tesla still holds the crown for all-battery electric vehicles (BEVs), BYD is closing the gap fast and could potentially seize the BEV crown by the end of 2023.

Let’s delve into the intriguing world of Tesla and BYD, comparing their sales, strategies, and the factors that set them apart.

Tesla’s Strategy: Quality Over Quantity

Tesla’s rise to prominence has been marked by its commitment to innovation and quality. In 2023, Tesla has aggressively cut prices multiple times to maintain robust deliveries.

However, this strategy has implications for its earnings, which are set to fall significantly this year.

Tesla’s vehicle lineup is relatively limited, primarily consisting of the Model S, Model X, Model 3, and the popular Model Y. While a revamped Model 3 is in the pipeline, the Cybertruck looms large as a future addition.

However, specifics such as launch dates, prices, and specifications remain uncertain. Elon Musk has hinted at a next-generation model, but details are scant.

The company’s decision to slash prices has enabled some of its vehicles, like the Model 3 and Model Y, to qualify for U.S. tax credits of $7,500. Tesla’s pricing strategy has been a rollercoaster ride, with occasional tweaks upward offset by price cuts, substantial inventory discounts, and other incentives.

Tesla’s Q3 production is expected to drop significantly due to factory upgrades. This may result in lower deliveries for the quarter. Interestingly, a prolonged UAW strike could potentially benefit nonunion competitors like Tesla in the U.S.

The company’s push for self-driving technology, including Autopilot and Full Self-Driving (FSD), continues. While FSD generates revenue, it remains a Level 2 driver-assistance system rather than a fully autonomous system.

BYD’s Strategy: Expanding Rapidly and Diversifying

BYD, on the other hand, has adopted a strategy focused on rapid expansion and diversification. The company reported robust Q2 profits and continues to set records in terms of sales.

BYD aims to achieve a sales target of 3 million vehicles by the end of 2023, a goal that necessitates an average of nearly 302,000 monthly deliveries for the remainder of the year.

BYD’s product lineup is more extensive and diverse than Tesla’s. They offer EVs with a wide price range, from $10,700 to $150,600, and consistently introduce new and refreshed models.

This approach has allowed BYD to rebound strongly from the EV price war initiated by Tesla.

In addition to their wide range of EVs, BYD also supplies batteries to Tesla, an intriguing twist that makes these two companies both competitors and collaborators in the EV market.

BYD’s global expansion efforts are impressive, with manufacturing plants in various countries. They’ve recently announced plans to build an EV factory in Thailand, Brazil, and possibly in Europe.

This expansion allows BYD to navigate potential trade barriers and protectionism more effectively.

The company’s upward trajectory extends beyond vehicle sales. BYD is also making strides in EV battery production, making it one of the world’s largest EV battery manufacturers.

Their Blade batteries and exploration into sodium-ion batteries are notable examples of their commitment to innovation.

Comparing Sales Figures

When it comes to sales figures, Tesla’s Q2 2023 deliveries were impressive, surpassing 466,000 vehicles. While this was a notable achievement, Tesla’s Q3 production has been significantly reduced due to factory upgrades, which could impact Q3 deliveries.

BYD, however, has been on a remarkable growth trajectory. In August, they sold a record 274,386 vehicles, with overseas sales surging as well. Their goal to sell 3 million vehicles in 2023 reflects their ambition and momentum in the EV market.

Tesla still leads in BEV sales globally, but BYD is poised to give them a run for their money, potentially even surpassing Tesla in the near future.

Market Cap Comparison

In terms of market capitalization, Tesla is significantly ahead with a market cap of $777.25 billion as of September 22, 2023, compared to BYD’s $85.7 billion.

Tesla’s market cap, although down from its peak above $1 trillion, reflects the company’s global recognition and leadership in the EV industry.

Conclusion

The battle between Tesla and BYD is a testament to the evolving landscape of the electric vehicle market.

While Tesla’s reputation for innovation and cutting-edge technology remains strong, BYD’s rapid expansion, diverse product offerings, and commitment to battery production make it a formidable competitor.

Both companies have distinct strategies – Tesla’s focus on quality and self-driving technology, and BYD’s emphasis on expansion and diversification.

It will be fascinating to watch how these two giants continue to shape the future of the EV industry, and whether BYD can indeed challenge Tesla’s position as the BEV leader in the near future.