In the ever-evolving world of technology, few stories are as compelling as the resurgence of Advanced Micro Devices (AMD).

Once considered a fading star in the semiconductor industry, AMD has undergone a remarkable transformation under the leadership of CEO Lisa Su.

This resurgence has led to substantial gains in the company’s market capitalization, prompting speculation about whether AMD can eventually reach the coveted $1 trillion mark by 2030.

In this article, we will delve into AMD’s recent successes, its financial prospects, and the challenges it faces on its path to trillion-dollar status.

AMD’s Strategic Focus:

Under the visionary guidance of Lisa Su, AMD strategically narrowed its focus to central processing units (CPUs) and graphics processing units (GPUs).

This strategic move allowed the company to thrive in the gaming and data center markets, where its processors have made a significant impact. Despite stagnation in client sales (chips for PCs), AMD’s concentration on CPUs and GPUs has borne fruit.

The acquisition of Xilinx expanded AMD’s presence in the embedded chip market, a sector experiencing substantial growth due to increasing demand from automotive, industrial, and other industries.

In the second quarter of 2023, AMD’s embedded chip segment was the fastest-growing, showcasing the company’s ability to diversify and capture new markets.

However, one challenge looms large for AMD: artificial intelligence (AI)-related chips. This market is currently dominated by Nvidia, making it difficult for AMD to challenge Nvidia’s supremacy.

While AMD has released advanced AI accelerators, it remains to be seen whether it can make significant inroads into this highly competitive space.

Financial Performance and Future Projections:

The semiconductor industry is notorious for its boom and bust cycles, and AMD has not been immune to this volatility.

Recent financials reflect a temporary slump in the chip industry, with revenue for the first half of 2023 dropping by 14% compared to the same period in 2022.

Rising operating expenses resulted in a GAAP loss of $112 million in the first half of 2023, following a net income of over $1.2 billion during the same period in 2022.

Nevertheless, it’s essential to remember that the semiconductor industry is cyclical, and downturns are an inherent part of its history.

AMD’s Q3 revenue estimate of $5.7 billion at the midpoint suggests a potential year-over-year revenue increase, offering a glimmer of hope. Consensus estimates project non-GAAP earnings of $2.01 per share in 2023, with expectations of doubling by 2025.

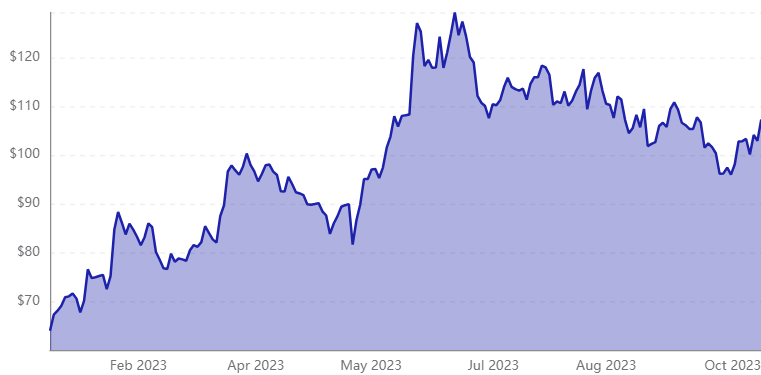

NASDAQ: AMD

NASDAQ: AMD

Challenges and Realistic Expectations:

While the prospect of doubling non-GAAP earnings in just two years may spark optimism, investors should maintain a level of caution.

The semiconductor industry’s unpredictability means that down years are inevitable, and AMD’s position in the AI sector, lagging behind Nvidia, raises questions about its ability to gain significant ground.

Reaching a market capitalization of $1 trillion is no small feat and would require sustained growth over an extended period. AMD’s strengths in gaming, data centers, and the embedded industry position it for continued revenue and profit gains.

However, it is improbable that AMD will achieve the $1 trillion market cap milestone in the next seven years.

The story of AMD’s resurgence is undoubtedly impressive, and the company has made significant strides under the leadership of Lisa Su.

While the $1 trillion market cap may remain a distant goal, investors can expect considerable returns from AMD over the coming years.

With its successful ventures in gaming, data centers, and the embedded market, AMD is well-positioned to build on its recent successes and remain a key player in the semiconductor industry.

While the road to $1 trillion may be challenging, AMD’s growth trajectory suggests that it will continue to be a noteworthy force in the tech world.