A big report from the Labor Department is coming out soon, and it’s expected to show that inflation—the rising prices of goods and services—isn’t slowing down much. This news isn’t great for regular folks, investors, or even the government, because they all want to see prices rise more slowly. If prices aren’t going down, it might be harder for the Federal Reserve (the folks in charge of money stuff) to lower interest rates later this year, which can affect how much you pay for things like loans.

The report looks at something called the Consumer Price Index (CPI), which basically tracks how much stuff costs in the economy. It’s predicted that both the overall CPI and a version that doesn’t include the prices of food and energy will go up by about 0.3%. That means, on average, prices are expected to increase by 3.4% and 3.7% respectively over the year. These numbers are higher than what the government ideally wants, which is around a 2% increase.

Experts like Dan North, who’s a senior economist, don’t think we’re making enough progress to get inflation down to that 2% target. The report is due to come out at 8:30 a.m. ET, and it’s likely to show that we’re still far from reaching that goal.

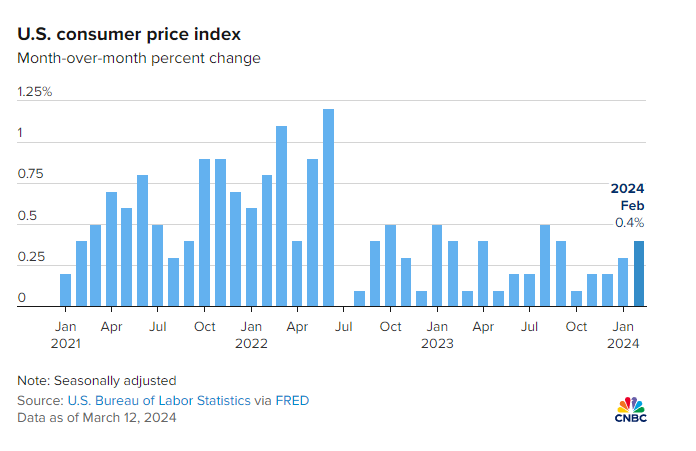

Although inflation has come down from its peak in June 2022, when prices were rising more than 9%, progress has been slow lately. Even though the Federal Reserve raised interest rates 11 times between March 2022 and July 2023 to try to slow down inflation, it hasn’t made a huge difference. Prices haven’t changed much since they stopped raising rates, though some measurements show a slight improvement.

Aside from the Labor Department report, the Federal Reserve keeps an eye on another indicator called the personal consumption expenditures index (PCE). In February, it showed inflation at 2.5% overall and 2.8% if you leave out food and energy prices. This indicates that inflation is still a concern.

People who invest in the stock market are getting nervous too. Even though stocks did well at the start of the year, they’ve been up and down recently because investors aren’t sure what to make of all this conflicting information.

Earlier this year, some investors thought the Federal Reserve would start lowering interest rates as soon as March and might keep doing it until 2024, making up to seven cuts. However, now it looks like any cuts might not happen until at least June, and there might be only up to three cuts, each just a small amount, according to calculations from the CME Group.