In the fast-paced world of trading, keeping a close eye on market indicators and trends can make all the difference.

In this blog post, we’ll take a closer look at a trader’s journey through the last three days of trading, highlighting key insights and strategies that led to substantial gains.

While the trading world can be complex, we’ll aim to provide a concise overview of the thought process behind the trades and the factors influencing them.

Market Pre-Battle: Setting the Stage

Before delving into the specific trades, it’s essential to understand the context that influenced the trader’s decisions. The trader noticed several indicators that hinted at a potential market shift:

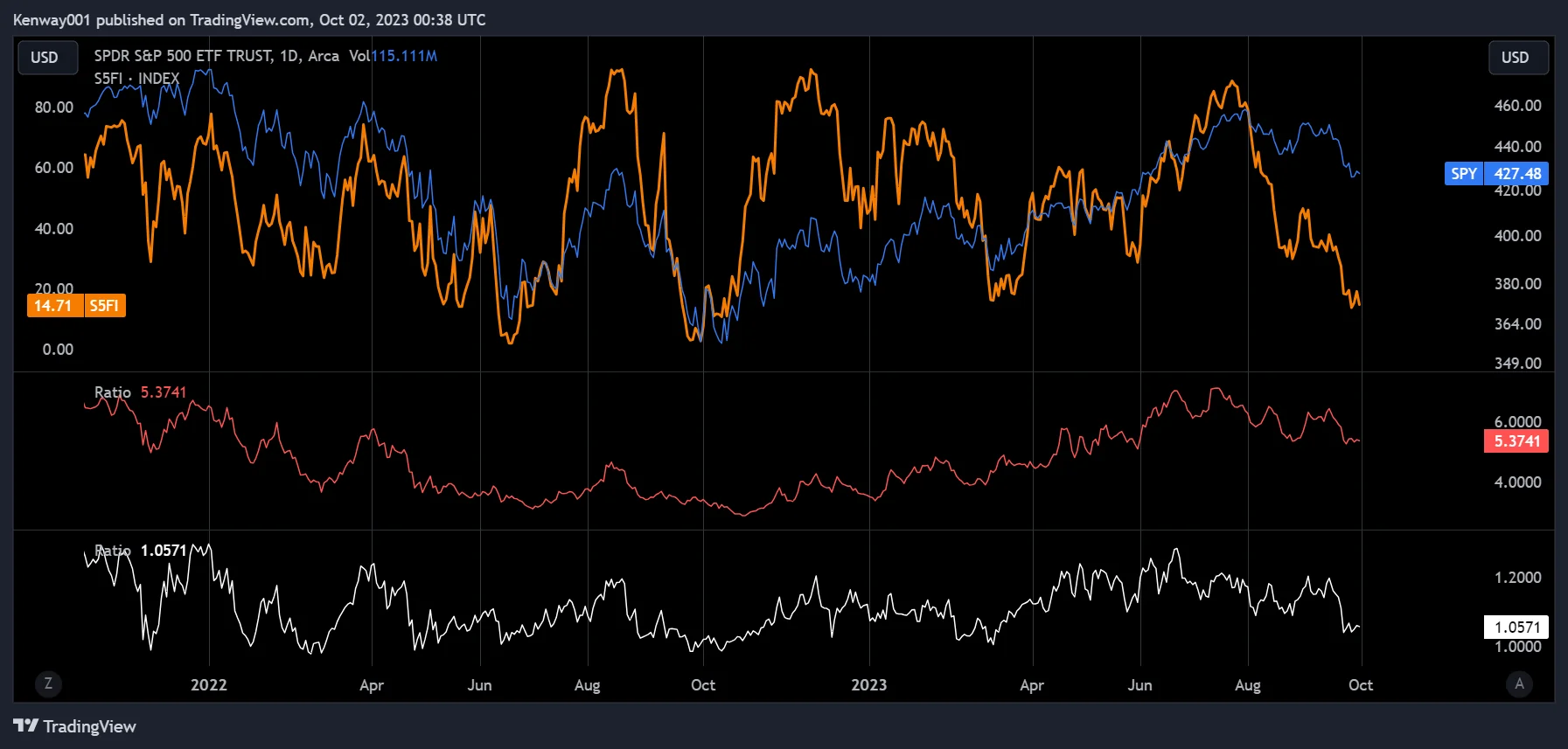

- Technical Market Depth: The S&P 500 % Stocks above the 50-day moving average (50ma) had reached historically low levels, similar to those seen during the banking crisis and the legdown in April-June 2022. This often indicated a bullish effect as big buyers stepped in.

- VVIX/VIX Ratio: The ratio of VVIX to VIX was at the same levels as the first correction from the market’s peak. This suggested a different type of legdown with potentially more momentum rallies.

- VIX3m/VIX Ratio: The VIX3m/VIX ratio was extremely low, approaching levels seen during significant market crashes. Such anomalies typically didn’t last in normal market scenarios.

The Battle Begins

With this context in mind, the trader embarked on a trading journey that spanned 150 trades over three days, primarily focusing on Nasdaq, S&P 500 (/es), and a few other instruments.

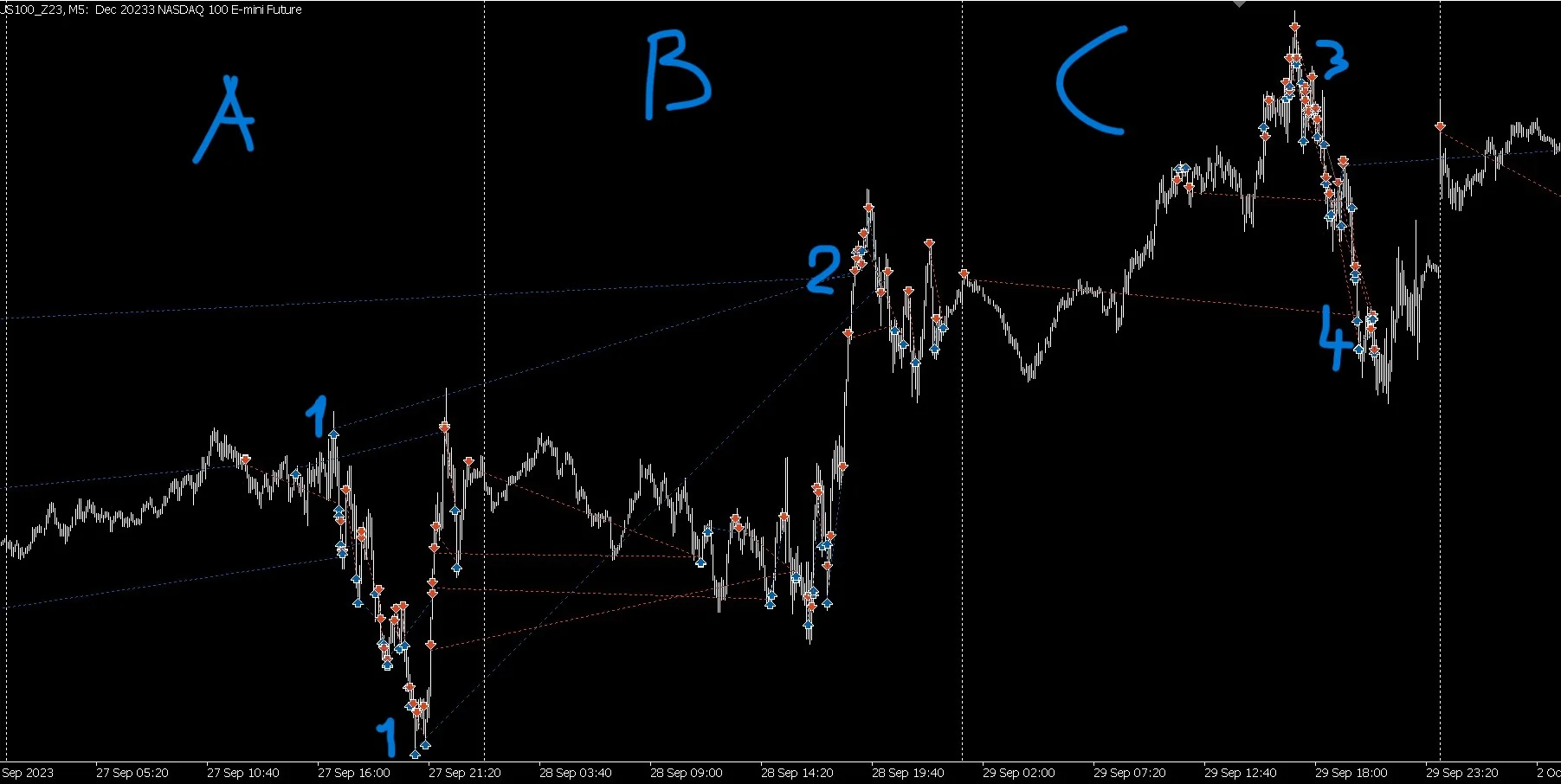

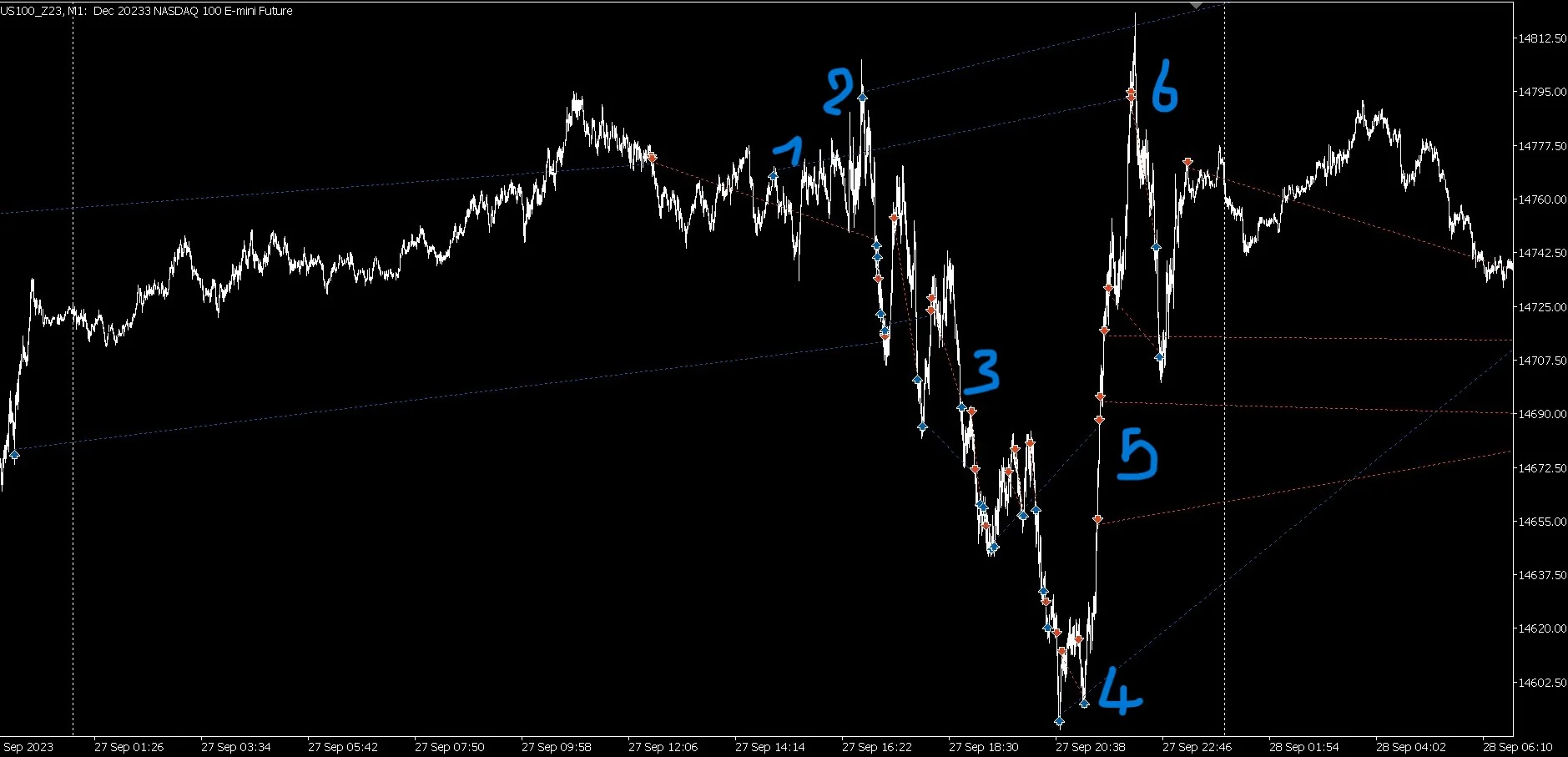

September 27: The trader initially intended to go long but faced early challenges with timing. Despite some losses, they managed to hedge their positions effectively and capitalized on a sudden market pump.

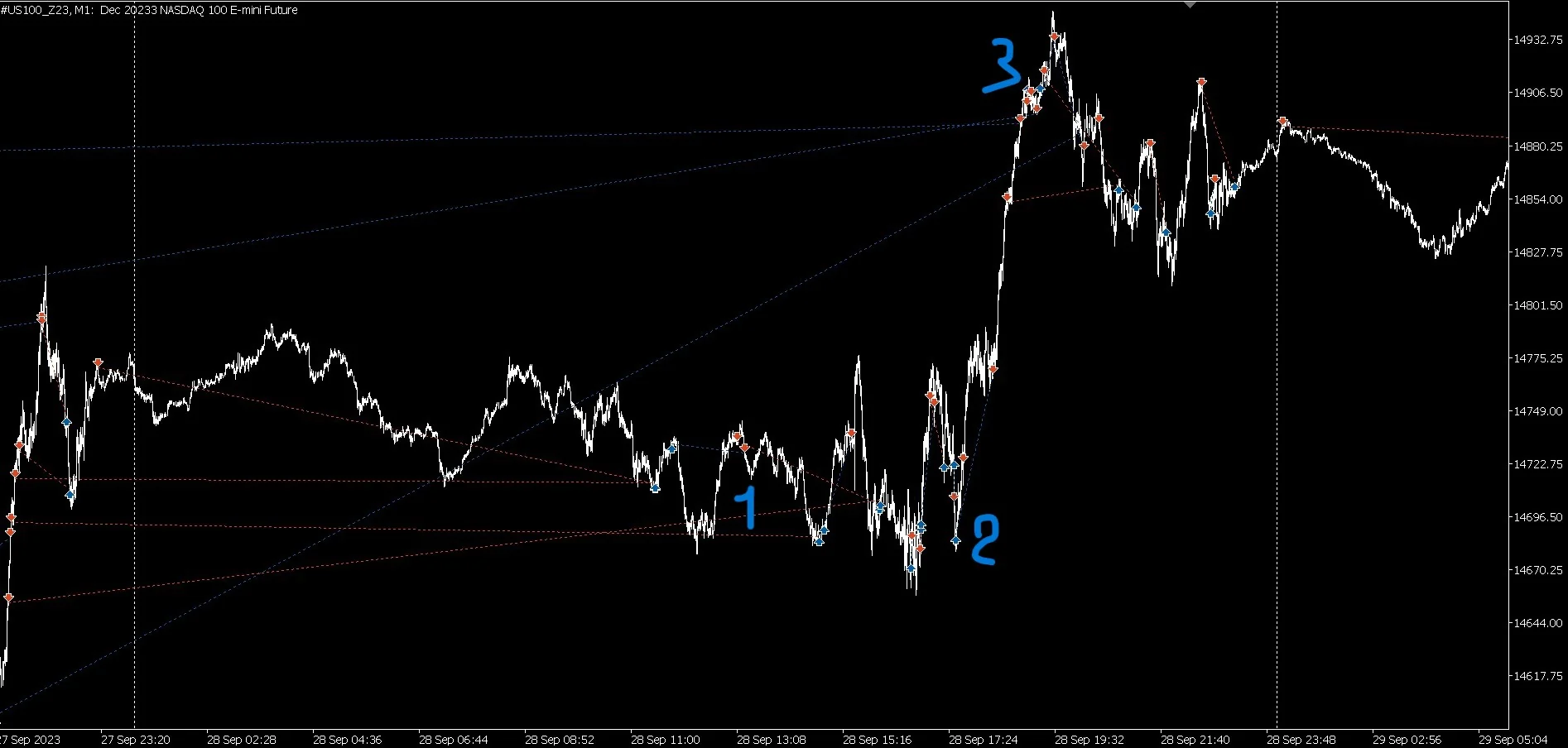

September 28: The Nasdaq corrected as expected, allowing the trader to remove downside hedges and secure profits on long positions. Scalping strategies were employed, taking advantage of momentum and VIX trends.

September 29: Market dynamics shifted once again with significant movements during the EU session. The trader recognized potential market manipulation, highlighting extreme SPX p/c open interest with high put open interest. They patiently built short positions, adding hedges to protect against intraday pumps.

Trading Insights and Strategy

Throughout these three days of trading, several key takeaways emerge:

- Adaptability: Successful traders must adapt to changing market conditions. The trader demonstrated flexibility, shifting between long and short positions as the market evolved.

- Risk Management: Risk management is paramount. The trader employed hedges to protect their positions and applied strict risk/reward ratios, which paid off in the end.

- Patience and Caution: Patience and caution are virtues in trading. Waiting for the right entry points and recognizing potential market manipulation can lead to profitable outcomes.

- Technical Analysis: Technical indicators like RSI and ADX were used to inform trading decisions, emphasizing the importance of technical analysis in trading strategies.

Trading in the stock market is a dynamic and ever-changing endeavor, requiring a keen understanding of market indicators and a strategic approach.

The trader’s journey over the past three days highlights the importance of adaptability, risk management, patience, and technical analysis in navigating the markets successfully.

While the trader’s short-term view shifted due to specific indicators, they maintained a long-term bearish perspective on the market’s overvaluation.

Trading is a multifaceted discipline, and these insights offer a glimpse into the complexity of decision-making in the world of finance.