The S&P 500, a widely watched benchmark for the U.S. stock market, has experienced its fair share of ups and downs over the years. While the market’s performance can be influenced by a multitude of factors, it’s essential to examine specific reasons when it underperforms. In this article, we’ll delve into five key factors that may have contributed to the S&P 500’s poor performance in the month of September.

1. Seasonal Weakness

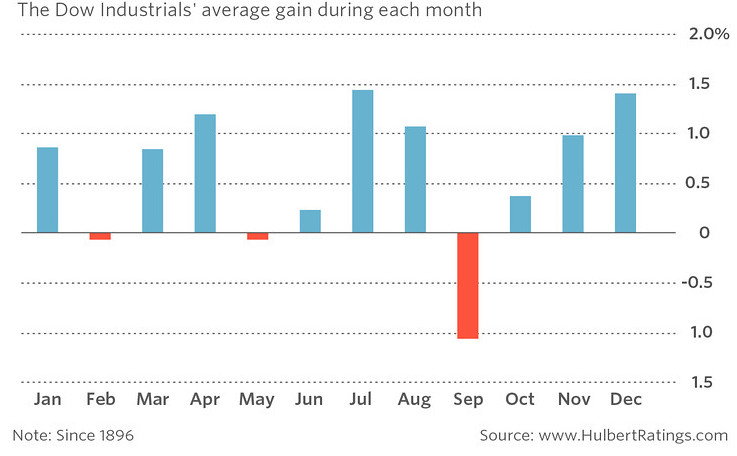

One recurring pattern in financial markets is the phenomenon known as the “September Effect.” Historically, September has been a lacklustre month for equities. Many investors believe that this weakness is tied to traders and institutional investors returning from their summer vacations and reassessing their portfolios. Additionally, corporate earnings announcements for the third quarter often create uncertainty and can lead to a degree of caution among market participants.

2. Rising Interest Rates

The Federal Reserve’s monetary policy decisions can have a significant impact on the stock market. In anticipation of potential inflation, the Fed may raise interest rates to cool down the economy. Higher interest rates can make fixed-income investments more attractive than stocks, which tend to be riskier. As a result, investors may shift their assets away from equities, causing stock prices, including those in the S&P 500, to drop.

3. Geopolitical Uncertainty

Geopolitical events and tensions can introduce significant volatility into financial markets. In September, these uncertainties can be exacerbated as leaders return to work after the summer months. Trade disputes, political unrest, and geopolitical conflicts can all contribute to investor unease, leading to a decrease in stock market performance.

4. Corporate Earnings Disappointments

Quarterly earnings reports can be make-or-break moments for companies and their stock prices. If a significant number of companies within the S&P 500 fail to meet earnings expectations, it can drag down the entire index. In September, companies often report their third-quarter results, which can be a particularly critical period for corporate performance assessment. If a substantial portion of these reports falls short of forecasts, it can lead to a poor showing for the S&P 500.

5. Overvaluation Concerns

Stock valuations are essential indicators of market health. When stocks become overvalued, it raises concerns of a potential market correction. September can be a time when investors, returning from summer break, reassess valuations and realize that certain stocks or sectors may be overpriced. As a result, they may sell off their holdings, causing the S&P 500 to decline.

Conclusion

While the S&P 500’s performance in September may be influenced by various factors, it’s essential to remember that short-term fluctuations are part and parcel of investing. Investors should take a long-term view of their portfolios and not be overly concerned with month-to-month fluctuations. Diversification, thorough research, and a well-defined investment strategy can help mitigate risks associated with market volatility. By understanding the factors contributing to poor September performance, investors can make more informed decisions and navigate the market’s ups and downs more effectively.