For more than a century, Wall Street has been the go-to place for investors seeking substantial returns on their investments, leaving commodities, housing, and bonds trailing in its wake when it comes to annualized returns

However, it’s crucial to recognize that the stock market, when viewed over shorter timeframes, becomes notoriously unpredictable.

In a world of financial uncertainty, investors are constantly on the lookout for economic data and predictive indicators to gain an edge in predicting the future of the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite.

While no crystal ball can guarantee precise forecasts of stock market movements, several economic indicators have demonstrated strong correlations with the major stock indexes.

One such indicator that is currently making headlines on Wall Street is the U.S. money supply—a phenomenon not witnessed since 1933 and possibly heralding a significant shift in stock market dynamics.

The U.S. money supply is measured using different standards, with M1 and M2 being the most popular.

M1 includes cash, coins, traveler’s checks, and demand deposits, while M2 encompasses everything in M1 plus money market accounts, savings accounts, and certificates of deposit under $100,000.

It is M2, the latter measurement, that has recently piqued the interest of investors.

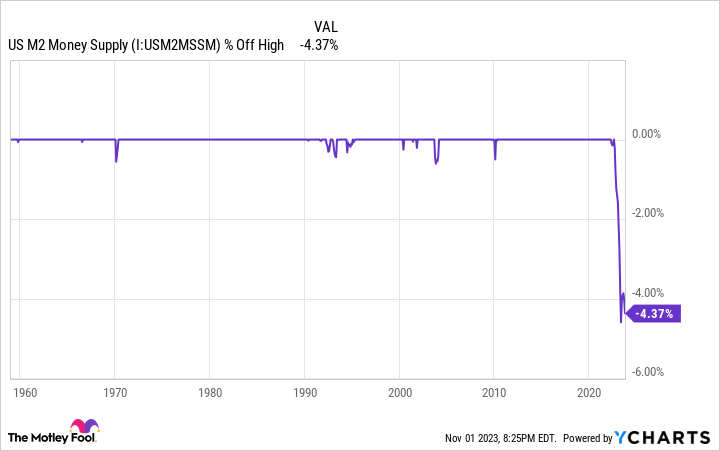

Traditionally, M2 money supply has steadily increased over the years, reflecting the growth of the U.S. economy. However, a remarkable trend has emerged over the last 15 months: a decline in M2 money supply since reaching $21.7 trillion in July 2022.

While small drops in M2 supply have occurred in the past, there have been only five notable instances of a meaningful decline of at least 2% on a year-over-year basis. Four of these declines took place in 1878, 1893, 1921, and 1931-1933.

The fifth, and the first since the Great Depression, is ongoing, with M2 money supply down 3.17% from the prior year and 4.37% from the July 2022 peak, as of September 2023.

This decline carries a two-fold significance. Firstly, it indicates potential economic implications, with less capital in circulation possibly leading to a downturn in the U.S. economy.

WARNING: the Money Supply is officially contracting. 📉

This has only happened 4 previous times in last 150 years.

Each time a Depression with double-digit unemployment rates followed. 😬 pic.twitter.com/j3FE532oac

— Nick Gerli (@nickgerli1) March 8, 2023

Secondly, historical data reveals that the previous notable declines in M2 led to deflationary depressions with double-digit unemployment rates.

While today’s economic landscape differs significantly from the early 20th century, the possibility of a recession and stock market decline cannot be ignored.

However, M2 is just one of several money-based metrics sending warnings to Wall Street.

Commercial bank credit, which includes aggregate loans, leases, and securities held by banks, has also seen a marked drop, tightening lending standards and potentially impacting the growth stocks responsible for driving the stock market higher.

The third-quarter Senior Loan Officer Opinion Survey on Bank Lending Practices from the Federal Reserve further supports this narrative, with nearly 51% of domestic banks tightening their lending standards for commercial and industrial loans to medium-sized and large companies. Such a trend, historically, has signaled a U.S. recession.

Nonetheless, perspective is a game-changer on Wall Street. While short-term traders may be concerned, long-term investors can view these economic shifts as opportunities in disguise.

Recessions and stock market corrections are normal and temporary aspects of the economic and investment cycle.

Over the decades, the U.S. economy has weathered numerous recessions, but most were short-lived. Historically, the stock market has seen longer bull markets than bear markets, offering optimism to long-term investors.

Time has consistently favored those with a patient investment horizon.

According to data from Bank of America Global Research, the probability of negative returns in the S&P 500 decreases significantly with longer holding periods, highlighting the benefits of a long-term investment strategy.

A 20-year investment in an S&P 500 tracking index, inclusive of dividends, has proven to be a consistent moneymaker for over a century.

In conclusion, while short-term financial trends may cause concern, investors with a long-term perspective can find reassurance in historical patterns. Wall Street’s cyclical nature suggests that staying focused on the bigger picture can lead to substantial rewards.