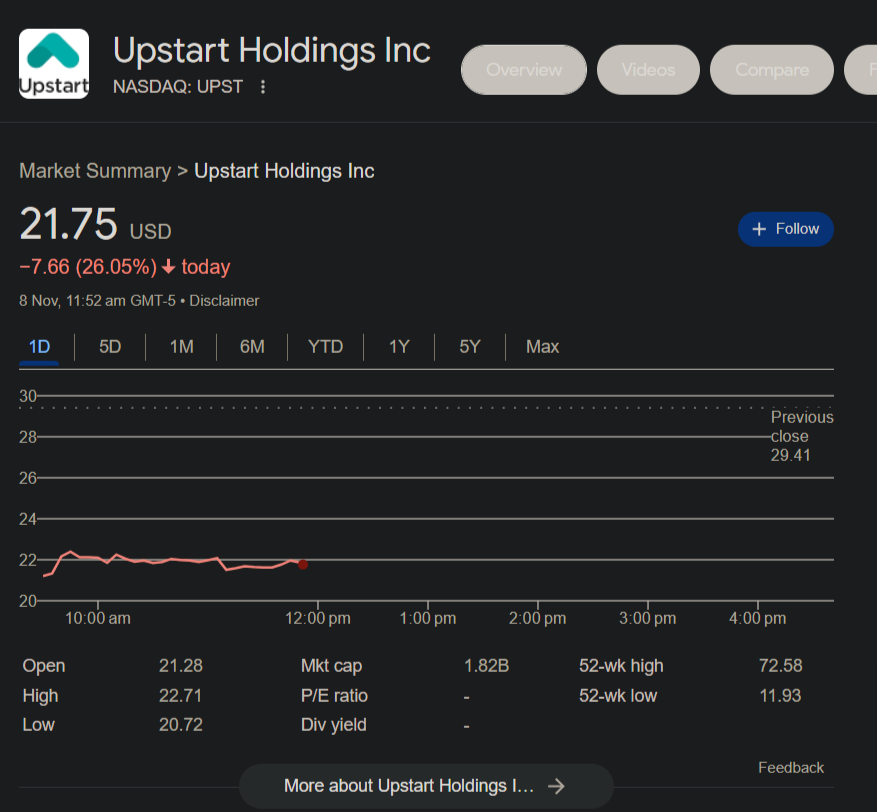

In a dramatic turn of events, shares of Upstart, the AI lending platform listed on the NASDAQ under the symbol UPST, took a nosedive of 20.2% during the morning session following the release of their third-quarter results.

This shocking decline was driven by the company’s failure to meet analysts’ revenue and EPS estimates.

But does this sharp drop present an opportunity for investors to consider buying the dip? In this article, we’ll delve into Upstart’s recent performance, the market’s reaction, and whether it’s the right time to invest in this innovative lending platform.

The Perfect Storm: Upstart’s Q3 report painted a challenging picture for the company’s performance. Not only did it miss revenue and EPS estimates, but the gross margin also declined, raising concerns.

Additionally, the company continued to burn cash, further unsettling investors. Weak guidance for the next quarter, which fell below consensus estimates, exacerbated the situation.

Upstart attributed these woes to a combination of factors, including unsustainable consumption patterns, lagging incomes despite increased labor participation, persistently low savings rates, and elevated borrower default trends.

The Way Forward: In light of the challenging macroeconomic environment, Upstart foresees that its business growth will primarily depend on model upgrades and enhanced underwriting accuracy.

These measures are expected to boost the company’s performance until the broader economic landscape improves.

However, it’s essential to recognize that the third-quarter results highlight some hurdles that the company must overcome to regain investors’ trust and resume growth.

Market Reaction:

The stock market often reacts sharply to news, and Upstart’s shares are no exception. Over the past year, the stock has experienced an astonishing 86 moves greater than 5%.

This kind of volatility is rare even for Upstart, indicating the significant impact of the recent news on the market’s perception of the company.

Comparing the current situation to a significant move six months ago when Upstart’s stock gained 35.6% after beating Q1 estimates, it’s evident that the market’s sentiment can swing dramatically based on the company’s performance.

In that previous instance, the company reported strong Q1 results, but it still struggled with cash burn.

However, it provided optimistic guidance, signaling a potential turnaround. Management highlighted its ability to secure long-term funding agreements worth over $2 billion, despite the macroeconomic challenges.

Investment Perspective:

Upstart’s stock has seen significant fluctuations, trading 69.5% below its 52-week high of $72.09 from July 2023.

While it has shown an impressive 69.1% gain since the start of the year, it’s essential to note that investors who bought $1,000 worth of Upstart shares at the IPO in December 2020 would now be looking at an investment worth $739.74.

This is a stark reminder of the market’s unpredictability and the need for careful consideration before making investment decisions.

Upstart’s recent tumble in stock price reflects the challenges it faced in Q3, as it failed to meet revenue and EPS expectations, and continued to burn cash. The company’s guidance for the upcoming quarter also disappointed investors.

While the market has been sensitive to Upstart’s performance, the company’s long-term prospects and the macroeconomic environment are significant factors to consider when evaluating the investment opportunity.

Buying the dip in Upstart may be tempting, but it’s crucial to conduct thorough research and consider the broader market dynamics before making any investment decisions.