In 2023, the USD/JPY currency pair has been on an impressive bullish run, gaining more than 14% since the start of the year.

This remarkable ascent has been primarily fueled by soaring U.S. Treasury yields, driven by a hawkish Federal Reserve policy stance.

However, the recent price action has shown signs of volatility, raising questions about the role of Japanese government intervention and the sustainability of this uptrend.

The USD/JPY Exchange Rate Rollercoaster

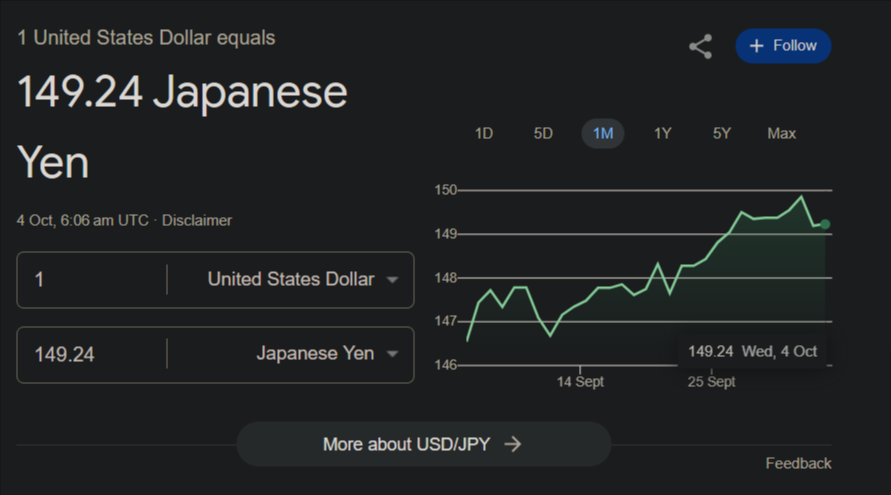

The year 2023 started on a bullish note for USD/JPY as it surged past 150.00, a level not seen since October 2022.

This rapid ascent, however, was met with a strong knee-jerk reaction, hinting at possible Japanese government intervention aimed at halting the yen’s depreciation.

While this intervention can temporarily stabilize the yen and deter speculative activity, it is unlikely to alter the long-term trajectory of the currency, given the prevailing market fundamentals.

Monetary Policy Divergence

One of the key drivers behind the USD/JPY’s bullish trend is the significant monetary policy divergence between the U.S. Federal Reserve (FOMC) and the Bank of Japan (BoJ).

The FOMC has adopted a hawkish policy stance in response to the strong U.S. economic performance.

In contrast, the BoJ has limited room for tightening due to the challenges facing the Japanese economy. This policy divergence creates a favorable environment for the U.S. dollar, attracting investors seeking higher yields.

Yield Differentials

A crucial factor contributing to the USD/JPY’s strength is the yield differentials between U.S. and Japanese government bonds. Over the past week, the U.S. 10-year Treasury yield surged beyond 4.75%, reaching levels not seen since August 2007.

Meanwhile, the Japanese 10-year note has remained relatively stable at around 0.76%.

These yield disparities provide a clear advantage to the U.S. dollar, making it an attractive choice for investors seeking higher returns on their investments.

Technical Analysis: Riding the Uptrend

From a technical perspective, the USD/JPY pair remains firmly entrenched within an unmistakable uptrend. To gauge the potential direction of the currency pair, we must consider key support and resistance levels.

Bullish Scenario:

- If USD/JPY manages to hold above the support level at 148.80, even after potential FX intervention, it could set the stage for another bullish move.

- A break above 150.00 would likely open the door for further gains, with the next target being 151.00, which represents the upper boundary of an ascending medium-term channel.

- In the event of continued strength, the focus would then shift to 151.95, presenting another level of resistance.

Bearish Scenario:

- In the event that bearish sentiment unexpectedly takes hold, initial support can be identified at 148.80, as illustrated in the daily chart.

- If the bears maintain control and push the price lower, the next key levels to watch would be 147.25, followed by a more significant support level at 146.00.

The USD/JPY’s impressive bullish run in 2023 is a result of several interconnected factors, including monetary policy divergence, yield differentials, and market sentiment.

While Japanese government intervention may temporarily pause the currency’s decline, it is unlikely to alter the prevailing market fundamentals.

Investors and traders should closely monitor key support and resistance levels, such as 148.80 and 150.00, to gauge the USD/JPY’s future direction.

The sustainability of this uptrend will continue to depend on economic developments, central bank policies, and global market dynamics.

As the year unfolds, the USD/JPY currency pair remains a fascinating one to watch, with both technical and fundamental factors shaping its trajectory.

Traders and investors should stay vigilant and adapt their strategies to navigate the ever-evolving landscape of the foreign exchange market.