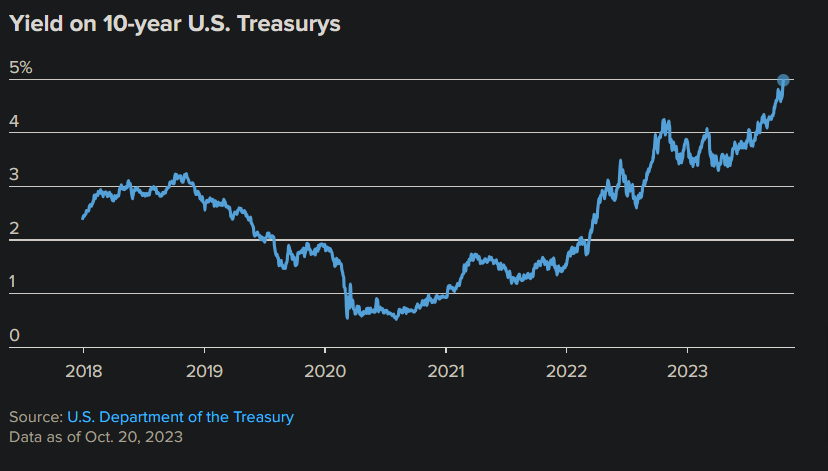

In a shocking turn of events, the 10-year Treasury yield surged past the critical 5% mark on Monday, sending shockwaves through various financial sectors and leaving consumers anxious about the implications.

This milestone, not seen in over 16 years, has raised concerns about its potential impact on mortgage rates, student loans, auto loans, and more. But what’s causing this surge in Treasury yields, and how might it affect you? Let’s dive in.

The Federal Reserve’s Inflation Fight

The recent spike in Treasury yields is primarily a result of the Federal Reserve’s aggressive interest rate policy. With high inflation rates causing economic turbulence, the Fed has been raising its benchmark interest rate since early 2022.

This effort to control inflation has pushed up bond yields, influencing the 10-year Treasury yield.

However, despite a decrease in inflation, the Fed remains resolute about keeping interest rates higher for a more extended period than anticipated, aiming to stabilize the economy.

Elevated oil prices have also played a role in stoking inflation fears, further impacting Treasury yields.

The Term Premium: Investors’ Caution

A significant portion of the rise in Treasury yields can be attributed to the term premium. Essentially, investors are demanding a higher return when lending their money to the U.S. government for a longer period—specifically, 10 years.

This surge in demand for higher returns is fueled by investor concerns about the mounting U.S. government debt. As the risk of the government’s inability to repay its debt increases, so do the returns investors demand.

The rapid ascent of Treasury yields may conceal a weakening economic picture, according to Tony Dwyer, chief market strategist at Canaccord Genuity Group. Despite the facade of higher rates, economic challenges may be accelerating.

The Impact on Mortgage Rates

One of the most immediate and direct effects of rising Treasury yields is on mortgage rates. For most Americans, their largest financial obligation is their home mortgage.

Presently, the average 30-year fixed-rate mortgage has risen to a staggering 8%, as reported by Freddie Mac.

This spells bad news for potential homebuyers as affordability slips further out of reach. The trend indicates that mortgage rates are likely to continue their ascent.

Student Loans: Feeling the Pinch

The correlation between Treasury yields and student loans means that students could also bear the brunt of this financial upheaval.

With college education already being a significant expense, the rising cost of borrowing may pose an even greater burden on students and their families.

For the 2023-24 academic year, undergraduate students taking out new direct federal student loans will be charged 5.50%, up from 4.99% in the previous academic year.

These annual rates are set based on the 10-year Treasury yield, which means that if the yield remains above 5%, student loan interest rates could climb even higher, increasing the financial burden on students.

Auto Loans: A Bumpy Ride

Auto loans are not immune to the impact of Treasury yields. The average rate on a five-year new car loan currently stands at 7.62%, the highest it’s been in 16 years. As a result, more consumers are facing monthly payments that may be beyond their means.

The affordability of cars may become a significant concern for many as these rates persist.

A Ripple Effect on Other Loans

While certain loans, such as credit cards, small business loans, and home equity lines of credit, are more closely tied to the federal funds rate, they, too, could be influenced by the rising Treasury yields.

Eugenio Aleman, chief economist at Raymond James, warns that “everything from business loans to consumer loans is going to be affected.”

As Treasury yields continue to rise, it’s possible that other interest rates may follow suit, adding to the financial pressures faced by individuals and businesses alike.

In conclusion, the 10-year Treasury yield breaking the 5% barrier is sending shockwaves through various aspects of the economy. The impact on mortgage rates, student debt, auto loans, and other forms of borrowing is undeniable.

As consumers brace for the potential financial storm ahead, it’s crucial to stay informed and make sound financial decisions to weather these challenging times.