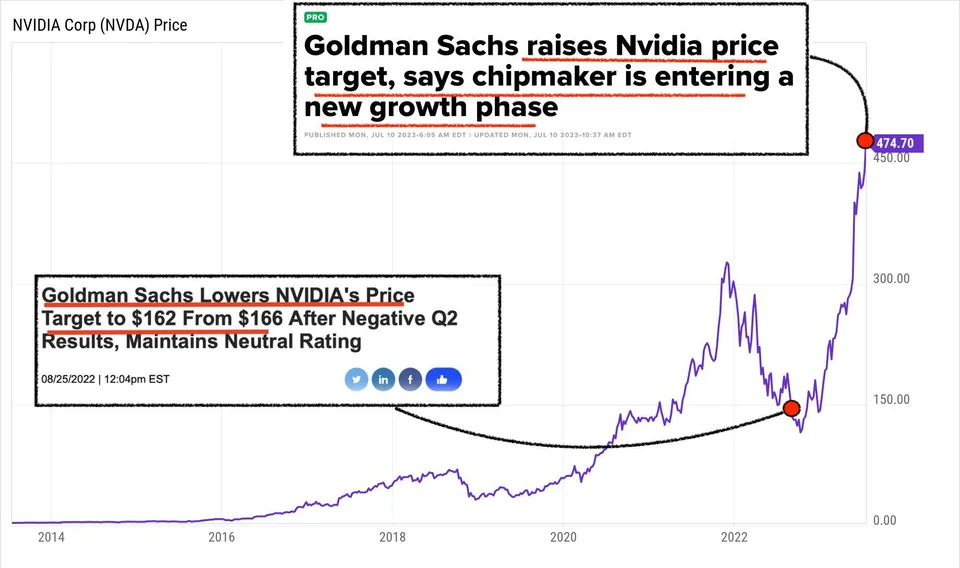

Nvda crush earnings again. But stock is down. Why?

Nvidia (NVDA) unveiled its third-quarter earnings post-market on Tuesday, surpassing Wall Street’s projections and maintaining the spotlight on artificial intelligence as a prime focus for investors. Earnings stood at $4.02 per share with revenue hitting $18.12 billion, outperforming analyst forecasts. Bloomberg data had anticipated earnings at $3.36 per share with revenue around $16.1 billion. Projections … Read more