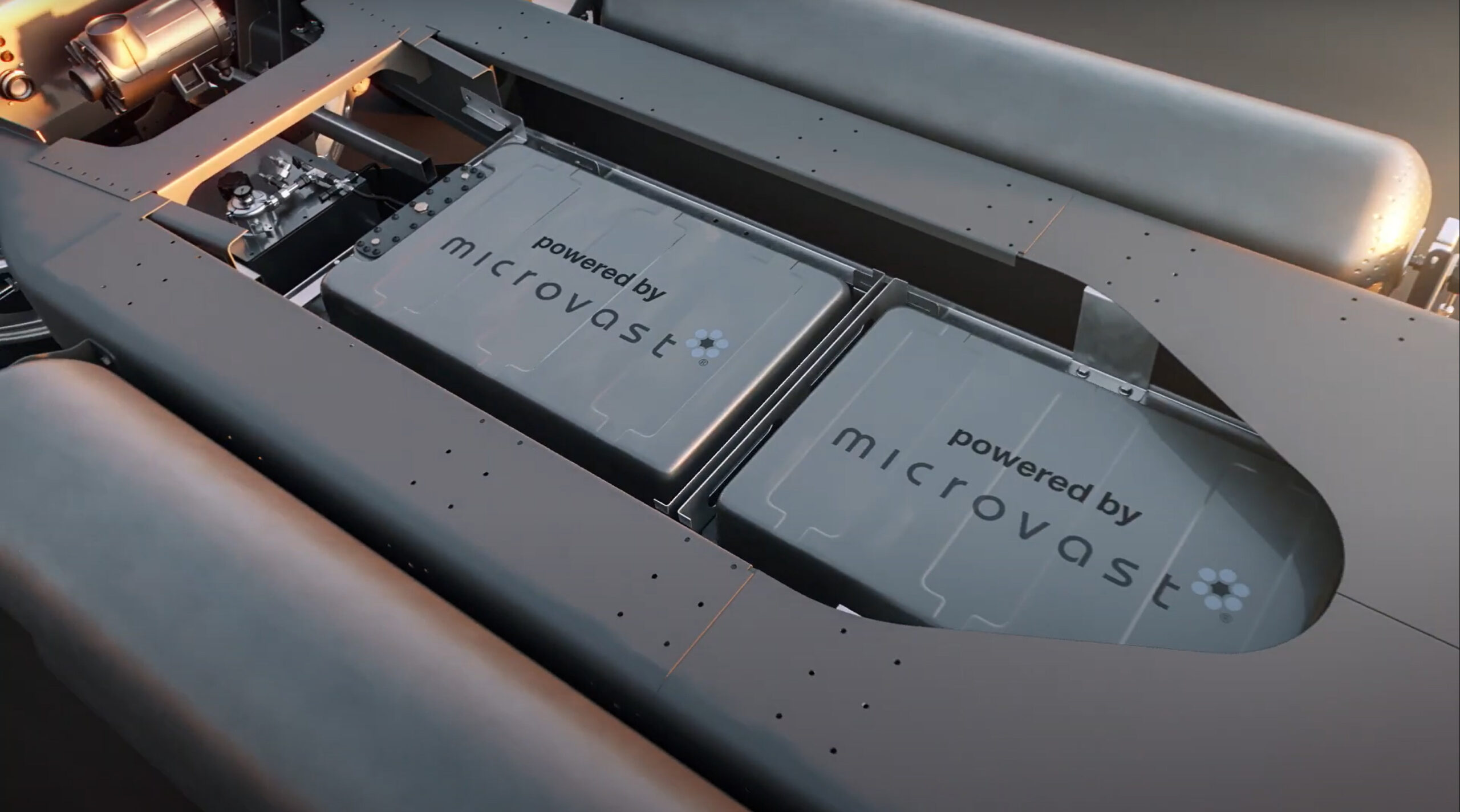

In the exciting world of battery manufacturing, one company that’s been making waves is Microvast. This small-cap battery manufacturer specializes in producing batteries for industrial-level energy storage and commercial vehicles. Unlike some of its competitors who have made headlines for all the wrong reasons (yes, we’re talking about battery fires), Microvast has been quietly building a reputation for reliability and quality.

Microvast entered the public market in 2021 through a merger with Tuscan, raising an impressive $822 million in cash. Since then, they’ve been on a mission to expand their reach globally, with a keen focus on the lucrative markets in North America, Europe, and Asia. Why? Because governments in these regions are pouring substantial subsidies into the electric vehicle (EV) industry and the companies that supply critical components like batteries.

One of the standout features of Microvast is its consistent track record of exceeding analyst expectations in its earnings reports. In the first quarter of 2023, they beat revenue predictions by a solid 21.14%, and in the second quarter, they still managed to impress with a 14.08% beat, even after analysts had adjusted their estimates based on the strong Q1 performance. This is not an isolated success either – Microvast has beaten analyst expectations in its last four earnings reports.

The company is now on the cusp of profitability, with two massive facilities set to open in Clarksville, Tennessee, and Windsor, Colorado, before 2024. To put this growth into perspective, Microvast’s current market capitalization stands at $564 million, while their backlog alone is valued at $675.9 million. As these new facilities come online, they will transform this backlog into revenue, potentially exceeding the company’s current market cap. Additionally, the expansion into North America will give Microvast increased exposure to manufacturers in the US and Canada, helping to reduce taxes and lead times.

One key advantage that Microvast enjoys is that they manufacture their own battery components, rather than relying on third-party suppliers. This not only ensures high-quality products but also improves their bottom line by cutting out middlemen.

Considering these factors, along with a consistent pattern of gains during earnings seasons, many investors see Microvast as a promising investment opportunity. Some are even eyeing call options with strike points set for November, anticipating the company’s forthcoming profitability and the commencement of production in its two massive factories.

In summary, Microvast’s journey in the battery manufacturing industry is gaining momentum, and their strategic expansion plans, impressive earnings track record, and commitment to quality make them an attractive player in the EV market. While the decision to invest should be made carefully and based on your own research, Microvast certainly seems to be a company worth keeping an eye on.