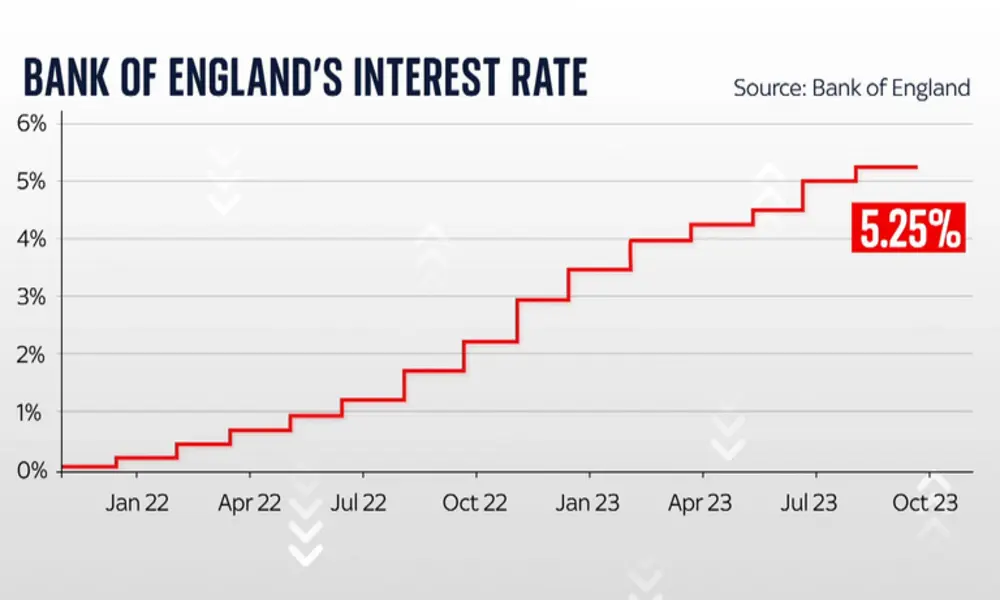

On September 20, 2023, the Bank of England made an unexpected announcement that sent ripples through the financial world. The bank decided to hold the current interest rate at 5.25%, marking the first time in two years that rates had not been raised.

This decision came in the wake of inflation data for August, which showed a slight decline in the rate of inflation to 6.7%, contrary to economists’ expectations of a rise to 7.1%.

A Promising Sign for the UK Economy

The unexpected rate freeze was seen by many as a promising sign for the state of the UK economy. However, it’s essential to note that this doesn’t necessarily mean that interest rates won’t rise later in 2023.

The decision to freeze the base rate, as opposed to raising it to 5.5%, was only narrowly passed with five to four votes.

This narrow margin indicates that this may be a temporary freeze rather than a turning point in monetary policy.

Impact on the Private Banking Sector

The Bank of England’s decision to freeze interest rates has implications for various sectors, including private banking. Industry experts have offered insights into how this decision may affect the private banking industry.

Nick Hyett, an investment manager at Wealth Club, pointed out the positive benefits of lower base rates for investment and private equity fundraising.

He noted that lower rates and yields can be good news for investor sentiment, which in turn benefits private banks that generate significant fees from their wealth management businesses.

When yields are high and the return on cash is attractive, investors tend to be hesitant about committing new capital to risk assets. However, if rates remain stable or start to decline, these businesses can gain momentum.

Hyett also mentioned the impact on private equity fundraising, stating that lower rates ease the pressure on a sector that often relies heavily on leverage. Cheaper access to capital and reduced refinancing threats can make deals easier to close.

International Implications

Hyett also highlighted the fact that the UK’s role in setting the global cost of capital is relatively marginal. Events in the United States are more likely to drive long-term performance in the private banking sector and financial markets as a whole.

Therefore, while the Bank of England’s decision is significant for the UK, it should be viewed within the broader global context.

Jason Holland, the managing director of Evelyn Partners, expressed optimism about the Bank of England’s decision, considering it a turning point for the UK economy.

He believed that the bank had made the right call to avoid driving the economy into a recession through excessive rate hikes.

While clients still face challenges from higher borrowing costs and increased taxation, the possibility of rates peaking and heading for a cut has improved sentiment, which is crucial for driving investment decisions.

Impact on Savers and Investors

Andy Mielczarek, founder and CEO of SmartSave, a Chetwood Financial company, discussed the tangible effects of the Bank of England’s base rate on savers and investors.

He highlighted the significant difference between the base rate and the interest rates offered by high street banks.

Many savers and investors have found themselves earning lower returns on their savings, penalized for their loyalty to larger banks.

While there are reports that interest rates won’t fall until mid-2024, the rate freeze offers a glimmer of hope after a turbulent couple of years for the UK economy in a post-pandemic and post-Brexit world.

The Bank of England’s unexpected decision to freeze interest rates at 5.25% has sparked discussions about its implications for the UK economy and the private banking sector.

While it offers some short-term relief and positive sentiment, it’s crucial to remain cautious, as the narrow margin of the vote suggests that this might be a temporary pause rather than a long-term shift in monetary policy.

The global context, particularly events in the United States, will continue to play a significant role in shaping the financial landscape.

As the UK navigates the challenges of a post-pandemic and post-Brexit world, savers, investors, and businesses will closely monitor developments in the financial markets to adapt their strategies accordingly.